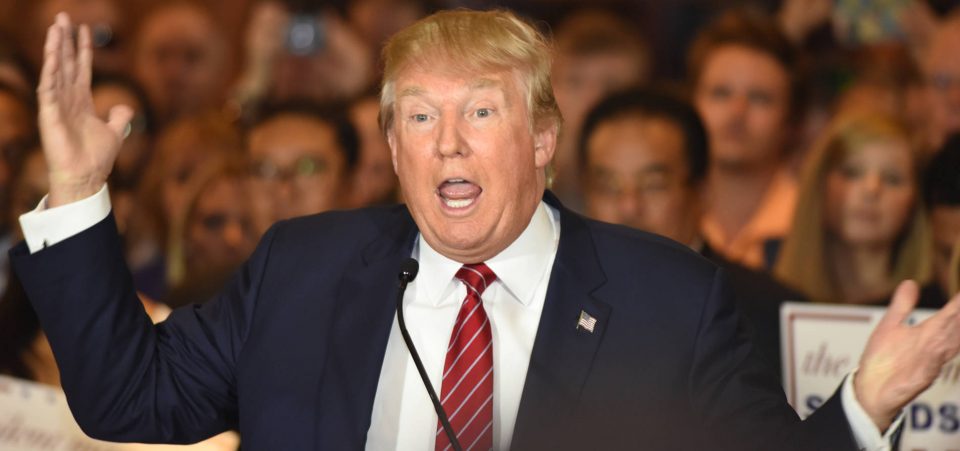

Trump to Invest $500.0 Billion in Crumbling Sector

Now that the thin veneer of the Donald Trump rally is beginning to take a breather, investors need to pull back the curtain and take a look at the state of the U.S. economy. Nothing has changed since Trump won the election. The U.S. economy remains fragile, the country’s growth prospects have been lowered, and underemployment remains high, as do personal debt levels.

The only thing that has changed is Wall Street’s enthusiasm for what a Donald Trump presidency will look like. In particular, his economic plans. But we’ll have to wait some time before that becomes more concrete. Trump has given some pretty solid hints about where he thinks investors should be looking to park their money over the next four years. On the campaign trail, Trump said he would cut taxes while spending more than $500.0 billion in infrastructure.

In his victory speech, in addition to cutting taxes, Trump said “We are going to fix our inner cities and rebuild our highways, bridges, tunnels, airports, schools, hospitals. We’re going to rebuild our infrastructure, which will become, by the way, second to none, and we will put millions of our people to work as we rebuild it.” (Source: “Transcript: Donald Trump’s Victory Speech,” The New York Times, November 9, 2016.)

Trump’s Infrastructure-First Policy

For a more detailed look at Trump’s infrastructure initiative, you simply need to check out his web site. In fact, one of the biggest areas of his web site is dedicated to infrastructure investment.

Trump notes that:

- “More than 60,000 bridges are considered structurally deficient, with traffic delays costing the U.S. economy more than $50.0 billion annually.

- Over the last four years, 2,000 water systems spanning all 50 states have shown excessive levels of lead contamination.

- According to the National Association of Manufacturers (NAM), without major improvements to the country’s transportation systems, the United States will lose more than 2.5 million jobs by 2025.

- According to the Wall Street Journal, more than a dozen energy infrastructure projects, worth about $33.0 billion, have been either rejected by regulators or withdrawn by developers since 2012. Blocking these kinds of projects leaves some communities without access to lower-cost fuel and higher-paying jobs.”

(Source: “Infrastructure,” Trump Pence, last accessed November 11, 2016.)

Trump believes his infrastructure plan will create thousands of new jobs in construction, steel manufacturing, and other sectors to build the transportation, water, telecommunications, and energy infrastructure needed to enable economic development in the U.S., which will also generate new tax revenue.

It could also be a boon for infrastructure firms and industrial metals.

Top-Performing Infrastructure Stocks

With half a trillion dollars expected to be spent on infrastructure (roads, bridges, airports, hospitals, and port facilities), these stocks could seriously outperform the market over the next four (or maybe eight) years. All of the following stocks have made solid gains since Trump won the U.S. presidential election. Chances are good that investors will enjoy some profit taking, and stocks could take a breather from the Trump bump, creating interesting entry levels.

Vulcan Materials Company (NYSE:VMC) is the largest producer of construction aggregates in the United States. Vulcan Materials produces and distributes aggregates (crushed stone, gravel, and sand), asphalt mix, calcium and concrete. Its aggregates are used in infrastructure projects such as highways, bridges, airports, utilities, railways, and public projects. (Source: “WHY INVEST,” Vulcan Materials Company, last accessed November 11, 2016.)

Jacobs Engineering Group Inc (NYSE:JEC) provides technical, professional, and construction services for industrial, commercial, and government projects mostly in the U.S., Canada, and the U.K. In 2015, the company raked in $12.0 billion in revenue, making it one of the world’s largest and most diverse providers of technical professional and construction services. Jacobs Engineering’s largest single customer is the U.S. government (about 20% of its revenues). (Source: “Company Profile,” Jacobs Engineering Group Inc, last accessed November 11, 2016.)

Southern Copper Corp (NYSE:SCCO) is one of the most integrated copper producers in the world. The company mines, smelts, and refines copper molybdenum, zinc, lead, coal and silver from its facilities in Peru and Mexico. Southern Copper has the largest copper reserves in the industry, with 73.2 billion pounds of copper and molybdenum reserves. (Source: “Reserves,” Southern Copper Corp, last accessed November 11, 2016.)